The global authority in superyachting

- NEWSLETTERS

- Yachts Home

- The Superyacht Directory

- Yacht Reports

- Brokerage News

- The largest yachts in the world

- The Register

- Yacht Advice

- Yacht Design

- 12m to 24m yachts

- Monaco Yacht Show

- Builder Directory

- Designer Directory

- Interior Design Directory

- Naval Architect Directory

- Yachts for sale home

- Motor yachts

- Sailing yachts

- Explorer yachts

- Classic yachts

- Sale Broker Directory

- Charter Home

- Yachts for Charter

- Charter Destinations

- Charter Broker Directory

- Destinations Home

- Mediterranean

- South Pacific

- Rest of the World

- Boat Life Home

- Owners' Experiences

- Interiors Suppliers

- Owners' Club

- Captains' Club

- BOAT Showcase

- Boat Presents

- Events Home

- World Superyacht Awards

- Superyacht Design Festival

- Design and Innovation Awards

- Young Designer of the Year Award

- Artistry and Craft Awards

- Explorer Yachts Summit

- Ocean Talks

- The Ocean Awards

- BOAT Connect

- Between the bays

- Golf Invitational

- Boat Pro Home

- Pricing Plan

- Superyacht Insight

- Product Features

- Premium Content

- Testimonials

- Global Order Book

- Tenders & Equipment

Yachts for Sale

For aspiring yacht owners looking for a luxury yacht for sale, we have put together a fine selection of luxury yachts and megayachts for sale from all over the world. Search BOAT International's collection of superyachts for sale and filter by type, length, asking price or age. Narrow the results by selecting specific features, or browse by speed, designer and much more.

Explore luxury yachts for sale

Search for everything from motor yachts for sale from renowned Dutch yards including Feadship and Heesen , premium Italian names including Azimut , Sanlorenzo and Benetti , popular British builders Sunseeker and Princess , and American megayachts for sale from US yards such as Westport .

Our collection also features sailing yachts for sale from legendary names such as Royal Huisman , Perini Navi , Nautor's Swan and Jongert , as well as some of the most well-known explorer yachts for sale .

Yacht Features

Propulsion System

SELENE YACHTS

Power yachts, luxury yachts, ocean yachts, news & events.

Sailing into the Future: Celebrating Selene’s Latest Marvels

Another remarkable journey with the final touchup and completion of the Selene 7220 at the Jet-Tern Marine shipyard… Continue reading

Expanding Horizons: Jet-Tern Marine’s Revolutionary New Production Facility

Expanding Horizons: Jet-Tern Marine’s Revolutionary New Production Facility… Continue reading

The Ingenious Bulbous Bow: Enhancing Performance and Efficiency at Sea

At the recent Selene Rendezvous in Solomon Island, a technical session was led by Howard Chen, the founder and lead designer of Selene Yachts… Continue reading

Three New Selene yachts launched in the water

… Continue reading

SELENE 62 OCEAN EXPLORER

The new Selene 62 Ocean Explorer is the very latest iteration of Howard Chen’s talent… Designed for a Selene repeat customer in Europe who wanted a yacht as beautiful and safe as any Selene, but faster in order to explore the Mediterranean Sea…

Since 1998 - 420 Yachts

We have built 420 yachts over twenty years. We are experts at the inspiration and unique hard work that it takes to build these luxury yachts.

Captain & Crew-Friendly

Knowing that our customer has to be both the captain and the engineer of the vessel, we have invested a lot of time in the design of our engine rooms .

Luxury Interior

Creative layout, that makes it both livable for a cruising couple and family-friendly . I nteriors with high quality design, joinery, varnish and upholstery are also some of our hallmarks .

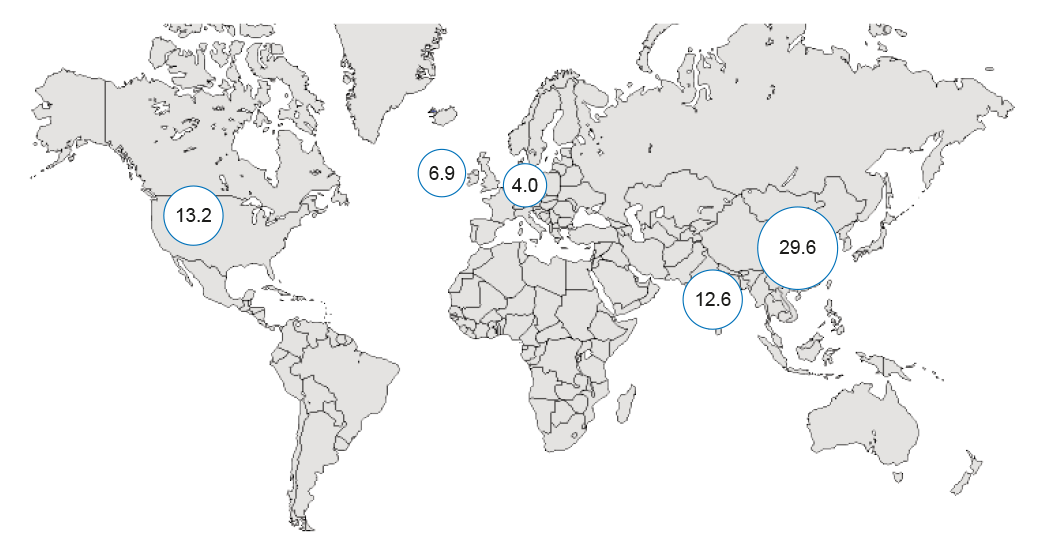

Selene Routes

SELENE 50 VOYAGER

The Selene 50 Voyager Sedan is a larger sibling of the 42 Voyager Sedan, with 3 cabins and the same European flair. The Selene Voyager series continues to build upon Selene Yachts’ tradition of combining the highest level of craftsmanship with superlative design.

SELENE 60 OCEAN EXPLORER

This brand new Selene 60 Ocean Explorer is the smallest vessel of the Selene Expedition line. A first look, the Selene 60 Ocean Explorer by Guido de Groot shows a number of the Selene family traits with her powerful raised pilothouse, Portuguese bridge…

SELENE 78 OCEAN EXPLORER

The Selene 78 Ocean Explorer, a cooperation between Selene Yachts and Guido De Groot, is a true and reliable explorer vessel with a stunning interior design, amazing outdoor entertainment space and the legendary Selene Yachts construction.

SELENE 128 OCEAN EXPLORER

Selene Yachts flagship of the Expedition line, the new Selene 128 will be soon in the production line for its European owner.

This brand new Selene 60 Ocean Explorer is the smallest vessel of the Selene Ocean Explorer line. A first look, the Selene 60 Expedition by Guido de Groot shows a number of the Selene family traits with her powerful raised pilothouse, Portuguese bridge…

Beyond the horizon

Choosing a boat, from the drawing board to the ocean, is always a major decision …

- Selene 38 Voyager Aft-cabin

- Selene 42 Voyager Aft-cabin

- Selene 42 Voyager Sedan

- Selene 50 Voyager Sedan

- Selene 92 Ocean Explorer

- Selene 98 Ocean Explorer

HOWARD CHEN

Read the Interview of Howard Chen, Founder of Selene Yachts

WHAT SELENE OWNERS SAY…

We wanted a compact yacht because we will load her on a cargo ship to explore new playing grounds like the Pacific Northwest or Northern European seas… It’s easily doable with a 42′ boat, and at a reasonable price. We want to see our new boat like a life enhancer and not as a financial or technical burden. This is why sizing the project, refining the specifications and a sound cooperation with the shipyard is essential, and Selene’s teams were ready to help from day one. We have found our perfect yacht…

I spent ten years as a full time vessel master and live-aboard owner. After obtaining my United States Coast Guard Master’s license, I spent countless hours cruising the waters of the San Juan Islands and the Canadian Gulf Islands.

Our constant, and the place we call “home” is M.V. Ellipsis, a Selene 60 Ocean Yacht delivered in 2007. We boat now without boundaries and enjoy navigating the rugged open waters off the west coast as much as we do the Inside Passage.

Summer and fall 2018, we will explore the Columbia and Snake Rivers, getting some experience with the locks on the river. 2019 should find us heading south in the Pacific, spending time cruising Mexico.

Even though my Selene 38 is the smallest in the range we’ve covered more than 20,000 miles in SE Asia; starting in Hong Kong, down to Vietnam and Borneo, then across to Thailand, later south to Malaysia and Singapore.

Everywhere I looked I was impressed with the quality. These are not production boats, but customized, handcrafted, solid vessels. Thank you for building us a beautiful and well founded boat! We look forward to many years of cruising in safety and comfort!

We want everyone in the yard to know just how happy we are with this wonderful boat you have made for us. Please convey our pleasure to everyone involved.

Our Selene « Adagio » has actually exceeded our expectations. Exceptional safety underway, comfortable for extended periods of live-aboard time, and excellence of workmanship are some of the reasons for our high level of satisfaction.

I went out on « Argo » today. The boat looks and performs fantastic. Convey my thanks to all the key people at the yard. The galley looks absolutely amazing. The new sound insulation you have done is really working with minimal vibrations!

We had a wonderful time in the San Juan Islands and Princess Louisa in British Columbia. The boat was perfect! We were in 25 knot winds with beam seas, some of which were well over 8 feet. « Mystic Moon » handled it perfectly!

FIND A DEALER

- The Selene Advantage

- Selene 60 Ocean Explorer

- Selene 72 Ocean Explorer

- Selene 78 Ocean Explorer

- Selene 128 Ocean Explorer

- Download Yacht brochures

- Howard Chen

- Interview with Howard Chen

- The Selene People

- News & Events

- Testimonials

- Construction details

- Press Articles

- Video Channel

- Selene Family Album

- Selene Rendezvous

- Selene Yachts Routes

- Meet John and Tracey

- Meet Captain Joël Marc

- Meet the Gulledges

Yachts For Sale

New and used boat and yacht sales with guidance every step of the way..

Our Bluewater yacht brokers have years of yachting expertise in the marine industry with in-depth knowledge of yacht sales, long standing relationships with shipyards and marinas and yacht crew alike.

Whether you want to purchase your first yacht, upgrade or sell your current vessel, our aim is to find your perfect yacht or the ideal buyer.

Bluewater’s expert brokerage services put buyers and sellers first, ensuring you are at the forefront of the fast-moving yacht sales market.

Bluewater prides itself on exceptional sales advice, market intelligence and sourcing the right yacht at the right price. No matter where you are based, you can benefit from listing or purchasing your yacht with our yacht brokers who are leading worldwide yacht sale experts in major yachting destinations such as the Caribbean, Fort Lauderdale and the Mediterranean.

We’re passionate about yachting and helping our clients by offering a full service and unrivalled support from start to finish – our commitment is defined as ‘One Company, One Complete Service’ with listings for a large selection of yacht brands such as Azimut, Benetti, Sunseeker and Princess Yachts, as well as departments dedicated to yacht charter, yacht management, yacht crew placement and crew training, to ensure we can cater for all of your yachting requirements.

Contact us today to find your dream yacht.

- €130,000,000

- €6,900,000

Endless Summer

- €2,950,000

Jasmine Luna

- €6,000,000

- €39,900,000

SEAGULL MRD

- €27,900,000

- GUNDERSON MARINE

- €1,850,000

LANGKAWI LADY

- Sterling yachts

- €3,200,000

- €3,250,000

Ocean-Going

Luxury yachts.

.webp)

Stunning woodwork and craftsmanship

customizable luxury

Efficient Long Range

Ocean-Tested Strength

faster delivery

-2.webp)

Ocean Explorer

Ocean Explorer 60

Ocean Explorer 72

Ocean Explorer 78

Classic explorer.

Classic Explorer 45

Classic Explorer 49

Classic Explorer 54

Classic Explorer 60

Classic Explorer 72

Ready to customize, ultimate yacht.

News - Find out about the latest news

Expanding our Factory - Building out an Additional 200,000+ Sq Feet of Modern Facilities

East Coast Selene Rendezvous 2023

The First Selene Ocean Explorer delivered to North America

Events - find out about the latest events.

2024 Selene Boat Show & Rendezvous Schedule, Get your Discount Code & Come See Us!

See what our happy customers are saying.

“My Selene 80 Ocean Explorer ticks all the boxes! We like fishing offshore and Howard Chen has beautifully extended the cockpit, adding working space, waterline and speed to this powerful fishing machine. I am also delighted with the very professional layout of the engine room with its twin Cummins and two generators. Hydraulic windlass, stabilizers and thrusters were also a must in my view. The bespoke interior general arrangements is also perfectly adjusted to our family lifestyle… South-East Asia, the Celebes sea, Torres straight, Australia and the Pacific Ocean are definitely on my bucket list!”

“Ever since I stepped aboard my first Selene, I knew there was something special about these yachts. You can see and feel the passion in the craftsmanship, and the woodwork is just breathtaking. What truly impressed me was the strength and stability of the yacht out in open water. And the fact that I could tailor some of the interiors to my liking? That was the cherry on top. Every voyage just feels like a dream.”

“We've had our fair share of experiences with different yachts, but Selene stands out. The Caribbean trip we took last summer was nothing short of luxurious. The decks, the interiors, the entire build screams quality. And I must say, getting our yacht delivered faster than expected was a delightful surprise. If you're looking for the perfect blend of comfort and adventure, Selene is where you find it.”

“We've had our fair share of experiences with different yachts, but Selene stands out"

Selene has a 25 year tradition of building elegant long range cruising trawlers for active adventures. Selene Yachts Americas is dedicated to connecting you with a Selene customized to meet your requirements and getting you on the water for experiences of a lifetime.

Frequently Asked Questions

We are the Selene Distributor for North America covering the US, Canada and Mexico.

We welcome the opportunity to have you involved and updated with each step of building your yacht including seeing your Selene while under construction at the factory.

A Trawler combines a more comfortable ride due to it's heavy full displacement hull and fuel efficiency that enables long-range cruising capability.

High quality woodwork, luxurious interiors, rugged build and a low profile design and that provides increased stability in a seaway.

Yes, there are many customizations available beyond what we display here including additional size boats and configuration options. Please contact us to learn more.

Stay Afloat with Selene Updates

Welcome aboard.

- THE PRINCESS PASSPORT

- Email Newsletter

- Yacht Walkthroughs

- Destinations

- Electronics

- Best Marine Electronics & Technology

- Boating Safety

Ocean Alexander 32E Reviewed

- By Chris Caswell

- December 15, 2023

When I arrived at the marina, I asked the dock master where the Ocean Alexander 32E was moored. He grinned and said, “Oh, you’ll see it.”

He was right. The 32E didn’t so much float as tower head and shoulders over most other boats in the marina. Think Arnold Schwarzenegger at a debutante ball, or Kilimanjaro above the plains of the Serengeti. This is a yacht for grand adventures on the seven seas.

The 32E’s profile is forward-loaded, tapering aft from a tall plumb bow. It’s clear that the two decks aft, off the bridge and salon, are designed for alfresco living, with a beach club at the transom. The swim platform is full-on watersports, with a 2,500-pound crane to handle tenders from about 16 to 18 feet long, as well as personal watercraft. There’s also room here for toys and dive gear. Both hull sides butterfly out to expand the yacht’s beam from just under 22 feet to 27 feet. The air-conditioned beach club provides a lounge for guests to watch the action in comfort.

On the main deck, the salon has defined zones for entertaining, including leather U-shaped Poltrona Frau couches from Turin and a formal dining area for 10 guests, with electric sliding doors on each side for fresh air.

The enclosed galley is pure gourmet, arranged around an island that allows two chefs to prep, cook and plate without crowding. Equipment includes a 30-inch, five-burner Wolf cooktop and a Fisher Paykel fridge, and there are Berwyn quartz counters.

A companionway leads to the owner’s main-deck stateroom. It spans the yacht’s beam (no walkaround side decks) with a king berth and two walk-in closets. The head has a free-standing hot tub, a heated stone sole and twin vanities. The lower deck has four en suite staterooms for guests. The VIP is forward with a queen berth and a love seat. Two mirrored staterooms are abaft the foyer with queen berths, and there’s a guest stateroom to port with twins.

Ocean Alexander has a long-standing mantra that “happy crews make happy owners,” which is why the 32E has a crew space abaft the engine room. Access is safe in all weather scenarios with 24-inch-wide side decks. There is an en suite captain’s cabin and a high-low bunk stateroom with a head for crew. The mess has a kitchenette with a sink, a microwave and a fridge, and a washer and dryer are provided for the crew.

What Ocean Alexander calls the bridge deck, I see as a sky lounge with an outdoor component. It stretches full beam from the four-person hot tub (wrapped by a sun pad) aft to the forward helm. Along the way is a Poltrona Frau sofa facing a full bar to starboard with four swivel stools and sole-to-ceiling windows. A day head is convenient to the deck and the sky lounge.

The helm, as expected from a builder with a long history of producing oceangoing yachts, has a trio of 24-inch Garmin touchscreen multifunction displays for navionics as well as a closed-circuit camera feed from the engine room and on deck. A Garmin remote is built into the armrest of the skipper’s pedestal seat. Two husky pantograph doors lead to the single-level foredeck, with a forward-facing dinette/lounge and a convertible sun pad that faces fore or aft.

Standard power for the 32E is twin 2,000 hp MAN V-12 diesels, and they live in an impressive engine room. The engines are separated by a diamond-plate walkway with safety rails, and there is access to all sides. Outboard are a pair of 40 kW Kohler gensets with equally good access. The 32E sets a benchmark for color-coded, secured piping and electrical runs. Delta-T intake and exhaust fans have vents in the cabin sides, rather than the hull, because Ocean Alexander expects the 32E to shoulder through big seas. The engine beds are welded stainless steel surrounding large structural stringers. There’s a smart lube-oil-change system for the mains and the gensets, and a Gulf Coast fuel-polishing system should ensure clean food for the diesels in faraway ports.

This 32E is also outfitted with Side-Power Vector zero-speed stabilizers, a 53 hp bow thruster and a 42 hp stern thruster. The Dometic air conditioning is rated for extreme tropical climates, with heating designed down to 40-degree water temps. The 50 hz Atlas Marine Power Converter allows automatic marina connections anywhere in the world, and the aerospace-designed Octoplex provides sensors and controls for the ship’s systems and lighting.

Underway, the Ocean Alexander 32E is going to cause immediate cravings for anyone who has dreamed of anchoring off the volcanic peaks of Moorea or nudging a glacier to get thousand-year-old ice for a gin and tonic. This yacht exuded power and strength from the moment the bow touched the Gulf Stream, and I found myself glancing at the fuel gauge to consider how far the 3,600-gallon capacity might take us. On the pins, the 32E topped out at 21 knots, in case owners need to outrun a squall. That’s impressive speed for a yacht with a 274,233-pound displacement. Dropping back to 800 rpm and 7.1 knots (the MANs will last forever), the yacht has a 2,430-nautical-mile range. That’s about the distance from New York to Panama or Los Angeles to Honolulu.

The stabilizers held the yacht rock-steady in the lumpy Gulf Stream, and departing from and returning to the marina was fingertip easy with the thrusters. The 32E that I got aboard also had optional engine controls on each after corner for even easier docking.

Creating such a solid ride starts with the 32E being built tough. It has an infused-fiberglass hull and closed-cell structural foam with unidirectional carbon-fiber reinforcement on stress areas, such as stringers. There is a reinforced collision bulkhead forward, and watertight bulkheads are forward of and abaft the engine room.

Owners of this yacht could throw a dart at a world map to choose their next waypoint. The Ocean Alexander 32E is ready to go.

Meet the Designer

Yacht designer Evan K. Marshall says he grew up with a stack of Yachting magazines in his closet and doodled boats on his notebooks in school. Marshall introduced the split-level owner’s stateroom to yachts. From his office on the River Thames in England, he produces innovative designs for builders from Ocean Alexander to Hatteras Yachts and more.

Robust Reinforcement

Ocean Alexander reinforces the 32E’s hull and deck with straight aircraft-grade aluminum beams that are reportedly 10 times stiffer than wood or fiberglass, but that help keep the yacht’s overall weight low for safety and seaworthiness.

The 2,000 hp MAN diesels on the Ocean Alexander 32E are Tier 3 compliant for Environmental Protection Agency emissions standards, and they have a MAN gold-standard warranty for 60 months. A V-12 designed for luxury yachts, this four-stroke engine has strong torque to 2,100 rpm and displaces 24.2 liters (1,476 cubic inches).

Take the next step: oceanalexander.com

- More: November 2023 , Ocean Alexander , Reviewed , Superyachts , Yacht Reviews , Yachts

- More Yachts

Riviera 585 SUV Reviewed

Meet the Maritimo Black Edition

Azimut’s New Flagship: Grande 44M

Meet The Italia Yachts Veloce 43

Fairline Squadron 68 For Sale

- Digital Edition

- Customer Service

- Privacy Policy

- Email Newsletters

- Cruising World

- Sailing World

- Salt Water Sportsman

- Sport Fishing

- Wakeboarding

View our fleet of superyachts for sale. Discover some of the world’s finest luxury yachts in our selection below.

Price Range:

Length Range:

The Finest Selection Of Luxury Yachts For Sale

The Moran fleet contains some of the world’s best superyachts for sale. From chic vessels like the UTOPIA IV to large mega yachts like the 95m MADSUMMER, we have something to suit every new owner. We pride ourselves on our expert, up-to-the-minute knowledge of the luxury yacht sales market, and with an enviable fleet, you can be assured that our yacht brokerage team will find the perfect yacht for you at the best possible price.

Moran ensures that every stage of the yacht sale is a pleasurable experience; from browsing our luxury motor yachts for sale to completing the final pieces of paperwork and after-sales support, we’ll be right by your side. But don’t just take our word for it. If you want to buy a yacht or are curious to find out more about our fleet, explore our selection of luxury yachts for sale below or get in contact today.

PATTI & ME

540 Sport Coupe

CA’D’ZAN

BAGLIETTO 48M

ACCREWED INTEREST

45M HAKVOORT

We enable your vision

Then you have to be prepared to head off the beaten track.

You want a team that feels like family, that can be entrusted to challenge your imagination and be challenged by you. Our ambition is to create and support the most advanced and inspiring yachts in the world. Together.

What if you want to go your own way?

Oceanco yachts tell the distinctive stories of their owners, who come to us with visions that go beyond the yachts that already exist. Sometimes, even beyond our notions of what a yacht can be.

Bravo Eugenia

Black Pearl

Tranquility

What if we lead a positive change?

Innovation is a continuous process of meaningful progress. Our clients come to us because they don’t want yet another iteration from a blueprint, they want a yacht that is theirs and theirs alone. Oceanco achieves meaningful innovation that is aligned with progressive thinking about how we live and the impact on our planet, working with trailblazers from inside and outside the industry to challenge the existing paradigm. We embrace collaboration, partnership and openness while checking our ego at the door.

Tomorrow’s Designs

Oceanco partners with luminaries of the creative world to spark your imagination. We plunge ourselves into the deep and don’t come up for air until we have nailed how to transform our bold ambitions into achievable designs.

Cookie preferences

Functional cookies help to perform certain functionalities like sharing the content of the website on social media platforms, collect feedbacks, and other third-party features.

Performance cookies are used to understand and analyze the key performance indexes of the website which helps in delivering a better user experience for the visitors.

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc.

Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. These cookies track visitors across websites and collect information to provide customized ads.

Other uncategorized cookies are those that are being analyzed and have not been classified into a category as yet.

You are using an outdated browser. Please upgrade your browser or activate Google Chrome Frame to improve your experience.

- Link to search page

- US: +1 (561) 833 4462

- US: +1 (206) 209-1920

- MC: +377 99 90 74 63

Expedition Yachts for Sale

For anyone looking for expedition yachts for sale, these are a quickly-growing market in the yachting world, as increasing numbers of yacht owners choose to get off the beaten track and indulge in some remote cruising! Here is the full current selection of all expedition yachts for sale worldwide with photos and full specifications for each.

Expedition yachts, often called explorer yachts, are extremely versatile. As much at home in the wilds of Alaska as sitting pretty in the glamorous port of Monaco, expedition yachts are built to cross the world’s oceans while offering the extraordinary comfort of a luxury yacht.

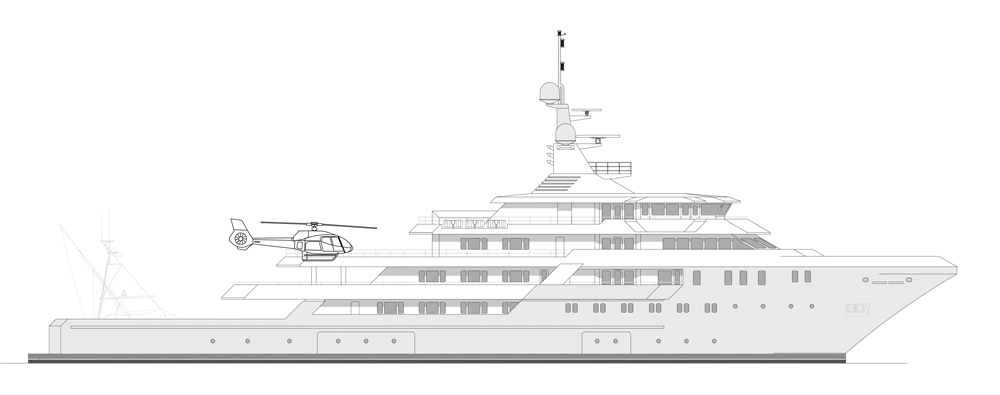

The explorer vessel featured above, LEGEND Expedition Yacht For Sale, is a 254-foot or 77m Icon Expedition yacht available for sale. She is the only ice breaking mega yacht in the world. The proven world cruiser features a panorama Jacuzzi on the main deck, large sales throughout, welcoming cocktail bars, Movie theaters, Exclusive Balinese Spa (pictured below) and a gym.

AKULA Expedition Yacht For Sale – for full specifications and photos, click on the link.

Expedition yachts for sale are also becoming increasingly common options for new-build construction projects, but there are also many existing expedition yachts that have been converted from commercial vessels. As such, often expedition yachts for sale have wonderful histories as research ships, hospital ships, ice-breakers, trawlers and military vessels, and are now enjoying their latest incarnation as impressive luxury yachts.

Often sporting a more functional exterior, the interior of explorer vessels are as palatial and luxurious as their traditional superyacht counterparts. Expedition-style yachts tend to have a wider beam, thereby offering more volume for larger cabins and interior spaces. The yacht’s generous interior spaces are designed for live-aboard comfort for extended periods, and many of these yachts will have living quarters or suites for the owners, rather than smaller cabins.

STAMPEDE Expedition Yacht For Sale – for full specifications and photos, click on the link.

Outside you’ll find generous open decks with elegant dining and entertaining spaces, with all the luxuries you’d expect on a superyacht. Jacuzzis, helipads and observation decks are common features found on expedition yachts for sale.

Expedition yachts are sometimes nicknamed ‘toy carriers’, as they have plenty of space to carry the tenders and water sports equipment you’ll want as you cruise exotic places. Explorer yachts for sale often carry crew who are trained as instructors, so you might learn diving, jetski, kitesurfing or even photography while cruising the South Pacific or the Galapagos.

Because they’re built as sturdy ocean-going vessels, expedition yachts are built with a strong focus on safety, self-sufficiency and comfort underway. Some expedition yachts have reinforced ice-breaker hulls for exciting Arctic expeditions, and all have modern stabilization technology and state-of-the-art safety systems. Expedition yachts are built with large fuel tanks giving them exceptional range, while onboard water-makers and excellent cold and dry storage allows them to make long sea voyages without needing to stop for supplies. Because they are built to be away from port for long periods, expedition yachts normally carry the best in communication, entertainment and Wi-Fi capabilities.

THE BIG BLUE Expedition Yacht For Sale – for full specifications and photos, click on the link.

Expedition yachts allow the yacht owner to get to all corners of the world, opening up beautiful destinations otherwise difficult to reach. From the snowy landscapes and penguins of Antarctica to the coral reefs and jungles of Micronesia, an expedition yacht opens up the world for exploration.

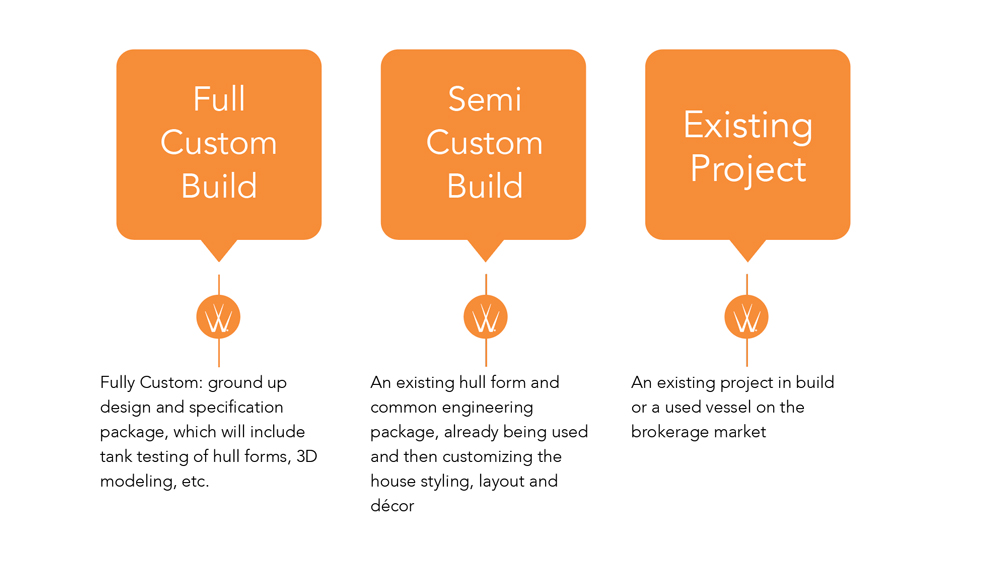

There are a multitude of options available for expedition vessels. Above are examples of existing brokerage vessels. Other options to consider include Full Custom Builds and Semi Custom Builds. A Fully Custom Expedition yacht build is a ground up design and specification package, which will include tank testing of hull forms, 3D modeling, etc. A Semi Custom Expedition Build includes an existing hull form and common engineering package, already being used and then customizing the house styling, layout and décor.

The 80m Explorer Yacht, unnamed, is an example of a Fully Custom Explorer Build. The vessel includes float in float out wet dock that will be able to hold a 65-70 foot sport fisherman in the stern, when the sport fish is removed the tender well becomes a deep swimming pool. She is diesel electric with Azipod drives. The vessel has the capability of landing two helicopters and can house both helicopters in a single hangar. The vessel also has a large tender garage that could hold multiple smaller vessels including a RIB, flats boat, jets skis and two submarines. The vessel has accommodations for 18 guests and crew of 36. The vessel would be commercial fit and finish on the exterior and the interior are envisioned to be built to high end cruise ship standards.

The 75m Explorer, by Admiral Shipyards is an example of a Semi Custom Build. The yacht’s exterior design, which remains unnamed, is a display of an elegant yet robust platform with generous exterior deck spaces. The expansive aft deck is designed to accommodate an Agusta Grande helicopter, complete with a storage and refueling hangar below deck.

The interior is spread across four decks and will be finished in a timeless nautical style that is finished with contemporary elements, which will be built and installed by German interio specialists, Fitz Interior. The owner, who is expected to spend prolonged period onboard, will be treated to an exclusive main deck area covering over 300 square metres with five additional guest suites on the lower deck.

Explorer yachts look a little bit different and offer extraordinary cruising potential, marking an exciting difference in the luxury yacht market for those who love an adventure on the open ocean. If you are be interested in viewing our full portfolio of exhibition yachts for sale, reach out to the sales team by email , by this sales inquiry form or by calling one of our yacht brokerage offices worldwide.

Puro, as spoken in Italian, is the essence of all things that are Pure...

OCEAN ALEXANDER has once again pressed new boundaries with our new Puro collection of luxury yachts for the global marketplace. The OCEAN ALEXANDER 35M Puro does not take stylized cues from yachts that find a niche in geographical markets, it is the embodiment of what pure yachting is, in any part of the globe. As you look at the intricate details of this luxurious masterpiece, your eyes are not drawn to one element, instead, the harmonious blend of rich features all leading to unrivaled functionality.

Yachts designed for the global marketplace will not follow trends, they will embody pure craftsmanship that does not compromise, eventually leading to timely obsolescence. The Puro 35 creates the perfect balance of pristine entertaining spaces, chiseled body formation, and uncompromised seaworthiness. Designed by renowned Italian architect Giorgio M. Cassetta in collaboration with Andrea Agrusta of NavalHEAD, this series presents the continued evolution of OCEAN ALEXANDER and our unwavering decades of commitment to yacht building in its purest form; welcome to the next benchmark.

Technical Specifications

Maximum Length

113′ 6”

Waterline Length

95′ 8”

24′ 5”

Draft (approx)

Displacement (approx)

318,037 lbs

Fuel Capacity

Fresh Water Capacity

Holding Capacity

Standard Generator

Twin Kohler® 55 KW

Standard Power

Twin MAN® 2000 HP

General Arrangements

" * " indicates required fields

- Current Models

- Custom Tenders

- Specifications

- Classic, Open, Havana & Construction

- Company History

- Awards & Certification

- Norsemen Shipyard

- Yacht Virtual Tours

Discover the magic of National Casino ! Australian players, are you ready for no deposit bonuses and epic wins?

Dive into a universe of endless fun at Pokie Mate Casino ! Spin your way to grand jackpots today!

Players can enjoy a variety of payment options, including traditional methods and cryptocurrencies, at Luxury Casino .

- CruiseMapper

- Cruise news

- Cruise Industry

- Scenic Group unveils next-generation luxury superyacht: Emerald...

Scenic Group unveils next-generation luxury superyacht: Emerald Kaia

Scenic Group has introduced the Emerald Kaia, the latest addition to Emerald Cruises ' luxury yacht fleet, marking a new era of ocean travel.

With a capacity for 128 guests, the Emerald Kaia strikes a balance between increased capacity and an intimate atmosphere, embodying Emerald Cruises' commitment to innovative luxury yacht cruising. Notable features include an expanded Sky Deck, now featuring a new internal Sky Lounge, providing guests with a luxurious open-air experience complemented by sweeping panoramic views. Furthermore, all cabins and suites have been redesigned with a 10% larger floorplan, offering guests enhanced comfort and contemporary living spaces.

The yacht boasts enhanced dining venues, revamped gym facilities, and an upgraded spa and wellness area, promising an unparalleled superyacht experience along coveted coastlines spanning from the Mediterranean, Adriatic, and Aegean Seas to the Seychelles.

Guests can expect delightful surprises throughout the spacious layout of the Emerald Kaia, including an Observation Sun Deck located at the bow, Sky Deck cabanas, a Sky Bar, and various dining options. The refined marina, now featuring an interior lounge and expanded water sports offerings, provides opportunities for luxury and adventure alike. Additionally, guests can access the marina from an open-air gym for a refreshing swim.

The expanded Elements Spa caters to those seeking holistic wellness experiences, reflecting the brand's commitment to nurturing the mind, body, and spirit.

Scheduled to set sail in April 2026, the Emerald Kaia is now open for consumer bookings and charters, with reservations commencing on April 10.

Guests can explore Emerald Cruises' new 2024-2027 Cruise Planner for detailed information on upcoming destinations and bespoke itineraries, promising enriching cultural experiences and elegant adventures on the high seas.

austrade tourism research australia

Contact an Austrade specialist as an investor as a buyer

Tourism and the visitor economy

State ecosystems

Spectacular and unique, Australia is an aspirational tourism destination for international travellers.

Thinking about entering the Australian market?

- Investors typically establish a new company, register as a foreign company or acquire an existing company. Assess your options with our Investor Guide .

- Austrade is Australia’s national investment promotion agency. We attract and facilitate game-changing foreign direct investment into Australia. Our team of business and investment specialists can connect investors to early-stage opportunities in Australia and provide direct and tailored professional assistance. Find out how we can help .

We enjoy an enviable reputation for our world-class cultural and natural attractions, from pristine beaches and rainforest to the opportunity to experience the oldest living culture on Earth.

After ten years of constant growth, we welcomed almost 10 million visitors in 2019 prior to the COVID-19 pandemic. We’re also a high yield market, with international visitors staying long and spending big.

Supported by the Australian Government’s visitor economy strategy, THRIVE 2030 , the sector has resumed its path to long-term sustainable growth, creating new opportunities for investors.

Australians holiday at home

Operators in Australia also benefit from a strong domestic market.

Australians are enthusiastic travellers and love to explore their own backyard. Increased domestic demand during the pandemic has continued; and in 2022 overnight and day trip spending by domestic tourists surpassed pre-pandemic levels.

- In a typical year, Australians account for around three-quarters of total tourism spend

- Australians make more than five domestic overnight trips a year on average

- In the September quarter 2022, spending on domestic overnight trips increased by 33% to A$27.8 billion, when compared to pre pandemic levels.

- By 2027, annual domestic overnight trip and day trip expenditure is expected to reach A$137.9 billion and A$41.1 billion respectively.

Poised to grow

International tourism is beginning to recover following the recent global disruption from the pandemic. Tourism Research Australia predicts international visitor expenditure will exceed pre-pandemic levels in 2024 before increasing to A$48.8 billion by 2027.

With our proximity to fast-growing markets in the Asia-Pacific, we’re well-positioned to recapture a significant share of global travel spend.

Our long-term national strategy for the visitor economy, THRIVE 2030 , sets out our plan to return to pre-pandemic visitor expenditure of A$166 billion by 2024, and grow it to A$230 billion by 2030.

Australia’s political stability and resilient economy offers prospective businesses and investors a safe and low-risk business environment.

And the Australian Government is backing the further recovery of Australia’s visitor economy, with a new $48 million tourism and travel package announced in the October 2022 Budget. The measures include plans to:

- attract workers to our vibrant tourism industry

- train and upskill new and existing hospitality and tourism workers

- support tourism businesses with activities that drive international travel to and from Australia.

Importantly, our THRIVE 2030 strategy supports sustainable growth. We know our natural assets, such as world-class nature and wildlife, are key to our attractiveness as a destination, and must be protected. In pursuing industry growth, we recognise that balancing social and environmental factors alongside economic ones is essential to sustain a truly healthy visitor economy for decades to come.

Top 5 visiting nationalities for the year ending September 2022: New Zealand India United Kingdom Singapore USA Visitors from India spent $1.3 billion in total which included $973 million in Australia in the year ending September 2022, around three-quarters of pre-COVID levels – demonstrating a strong recovery for this market.

Australian tourism fast facts

Source: STR and TRA , based on pre-COVID 2019 data

- Total tourism worth A$166 billion

- International tourism worth A$45.4 billion, including $31.4 billion spent onshore

- Ranked 2nd globally for international visitor spend per trip

- Domestic spend grew around 6% per year for the 10 years to 2019

- 7th largest tourism market globally

- Australia’s 4th-largest export industry

- More than 88,000 international visitors spent more than $1,000 per night in Australia, with another 387,000 spending between $500 and $999

Unique cultural experiences

Australia offers visitors the unique ability to experience the oldest living culture on Earth – that of Australia’s First Nations peoples.

First Nations tourism gives visitors a unique insight into the relationship Aboriginal people have with the land and sea – their Connection to Country – helping them create a deeper connection to Australia.

In 2019, 1.4 million international visitors (17 per cent) participated in an Indigenous tourism experience while visiting Australia, a six per cent year-on-year increase since 2010. For domestic travellers, the figure was one million, an increase of 13 per cent each year since 2013.

Wine and dine where the food is fresh

Australia’s award-winning restaurants and wineries serve up fresh produce from our unspoiled landscapes, while our cafes have made coffee an art form. Add to this a packed calendar of events that draws travellers year-round and you have a world-class tourism offering.

Food and wine accounts for 1 in 5 dollars spent by international tourists in Australia.

Soaking up nature

Potential visitors rank Australia first for its world-class nature and beauty (Consumer Demand Project, Tourism Australia. Dec 2022). From pristine rainforests to spectacular beaches and vast outback plains, Australia’s stunning natural landscapes offer something for every traveller. Australia frequently appears on top 10 lists of the most world’s most beautiful countries, such as the 2022 Rough Guides reader’s vote .

Our diverse and unique ecosystems are home to a huge variety of plants and wildlife, much of which is found nowhere else on earth. This precious natural heritage is protected in thousands of parks and conservation reserves that dot the country.

The World Economic Forum ranks Australia number one for natural resources, based on both our natural beauty and highly developed outdoor tourism industry.

Australia offers abundant opportunities for businesses looking to offer nature-based experiences. With such an expansive natural environment – including a continuous coastline stretching some 30,000 kilometres – innovative businesses have the chance to look beyond familiar destinations to craft travel experiences that are new and truly unique.

Wellness tourism Going to a health spa, sanctuary, or well-being centre is growing globally. In 2019, day and overnight travellers participating in wellness activities increased by 10.4% from 2018. In 2021-22, travellers participating in wellness activities increased 21% compared to 2020-21.

Incentives, grants and support

- Austrade supports the tourism industry to innovate and build long-term sustainable growth.

- The government’s tourism promotion agency Tourism Australia supports tourism businesses by attracting international visitors to Australia. Come and Say G’day is the new global campaign to support the Australian tourism industry rebuild.

- A number of tourism investment resources are available to help you invest and make informed decisions. Tourism Research Australia provides statistics, research and economic data on domestic and international tourism to assist the government and tourism industry.

- The Australian Tax Office’s New Investment Engagement Service gives tailored guidance on tax issues to businesses planning significant new investments in Australia.

Reports and publications

Browse our range of reports and publications including performance and financial statement audit reports, assurance review reports, information reports and annual reports.

View reports and publications

The aim of audit insights is to communicate lessons from our audit work to make it easier for people working within the Australian public sector to apply those lessons.

View ANAO Insights

Work program

The ANAO work program outlines potential and in-progress work across financial statement and performance audit.

View the work program

Our staff add value to public sector effectiveness and the independent assurance of public sector administration and accountability, applying our professional and technical leadership to have a real impact on real issues.

View Careers

The Australian National Audit Office (ANAO) is a specialist public sector practice providing a range of audit and assurance services to the Parliament and Commonwealth entities.

Strengthening Australia’s Tourism Industry

Please direct enquiries relating to reports through our contact page .

The objective of this audit was to assess the effectiveness to date of the implementation of the Tourism 2020 strategy by the Australian Trade and Investment Commission (Austrade) and Tourism Australia.

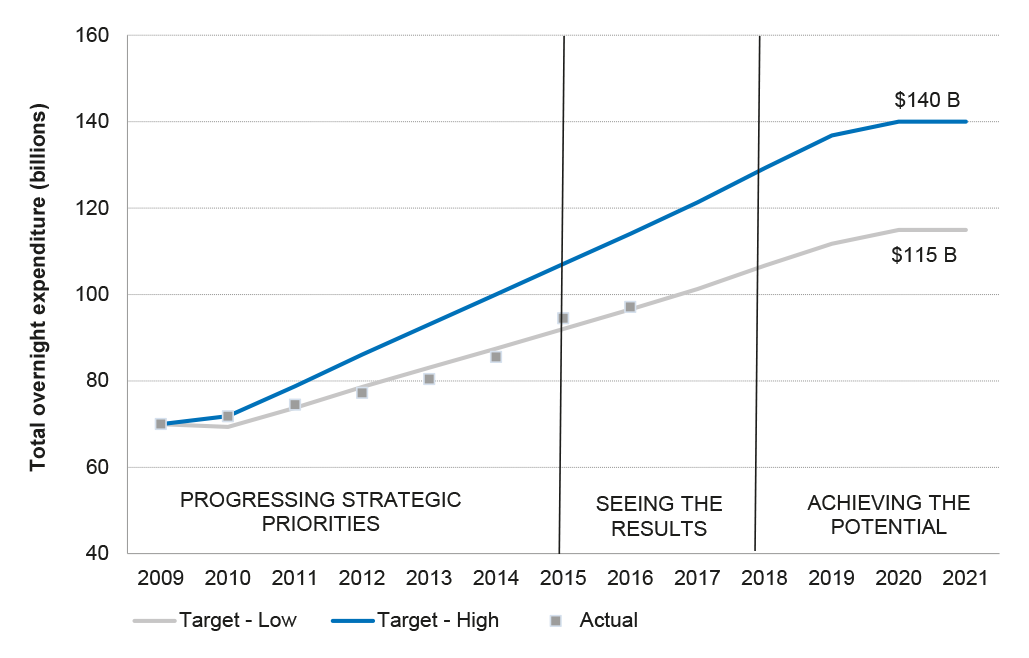

Summary and recommendation

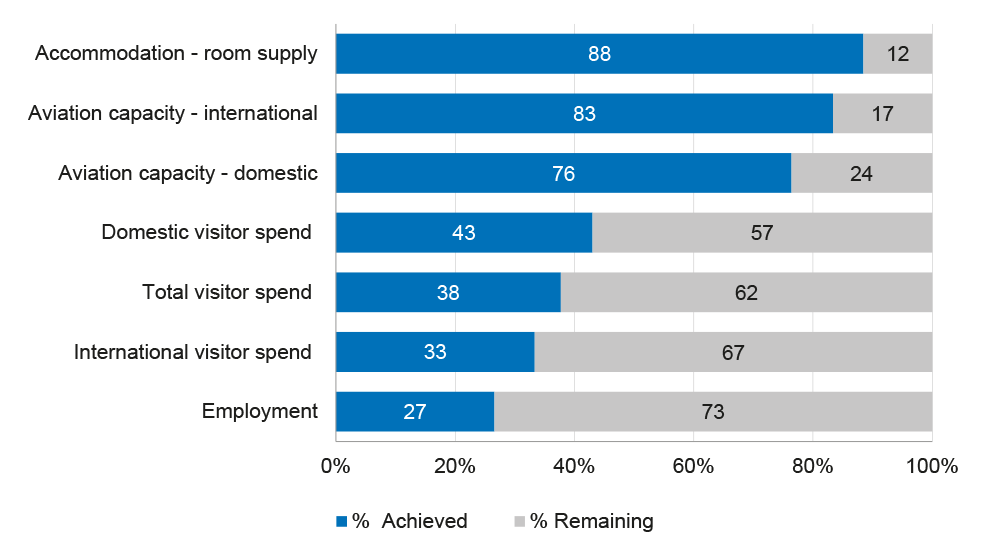

1. Tourism 2020 is a whole-of-government strategy designed to build the resilience and competitiveness of Australia’s tourism industry. The strategy seeks to increase the demand for travel to and within Australia, as well as addressing a range of factors governing the supply of tourism services including investment, labour supply and tourism-related infrastructure. A Tourism 2020 goal has been established to achieve a potential overnight visitor spend (combined domestic and international) of between $115 billion and $140 billion annually by 2020 (up from $70 billion in 2009).

2. Launched in December 2011, Tourism 2020 is the result of a policy process that commenced in May 2008 when the Australian Government announced its intention to develop a long term tourism strategy to address the decline in Australia’s share of international tourism. Within a commonwealth/state framework, the Australian Trade and Investment Commission (Austrade) is responsible for coordinating and facilitating the implementation of Tourism 2020 at a national level. Tourism Australia is the Australian Government entity responsible for attracting international visitors to Australia both for leisure and business events.

Audit objective and criteria

3. The audit objective was to assess the effectiveness of the implementation of Tourism 2020 by Austrade and Tourism Australia.

4. To form a conclusion against the audit objective, the ANAO adopted the following high level criteria:

- implementation of Tourism 2020 and associated policy development was supported by a sound evidence base, including effective engagement with government and industry;

- monitoring of the Tourism 2020 target and strategies has been based on robust performance measures; and

- Australian Government funding for tourism has been allocated on a sound and transparent basis.

5. The arrangements adopted by Austrade and Tourism Australia have supported the effective implementation of Tourism 2020.

6. Implementation of Tourism 2020 and associated policy development has been underpinned by an evidence base led by Tourism Research Australia (within Austrade) in collaboration with Tourism Australia. Tourism Ministers’ meetings have provided an effective forum for cross government collaboration and industry representatives have been consulted in the formulation of key priorities and strategies for Tourism 2020.

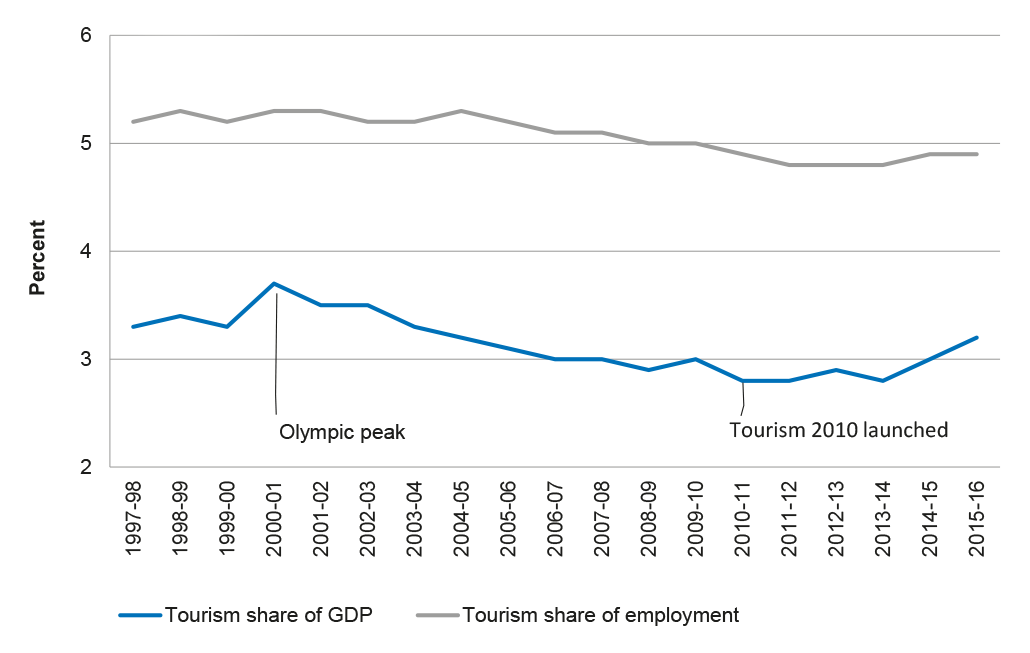

7. Monitoring and reporting of progress against the Tourism 2020 target and key strategies by Tourism Research Australia have been based on robust performance measures. Regular reporting of progress against the Tourism 2020 target for overnight visitor spend is a strength of Tourism 2020. In addition, the key performance indicators developed against broad strategies have provided relevant and reliable measures of performance. However, the lack of an assessment of the overall economic impact of Tourism 2020 is a gap in the performance information—that is, the extent to which the Tourism 2020 policy initiative has contributed net benefits to Australia’s economy and general living standards. This aspect of performance should be assessed as part of an evaluation of Tourism 2020 that is planned for later in 2017.

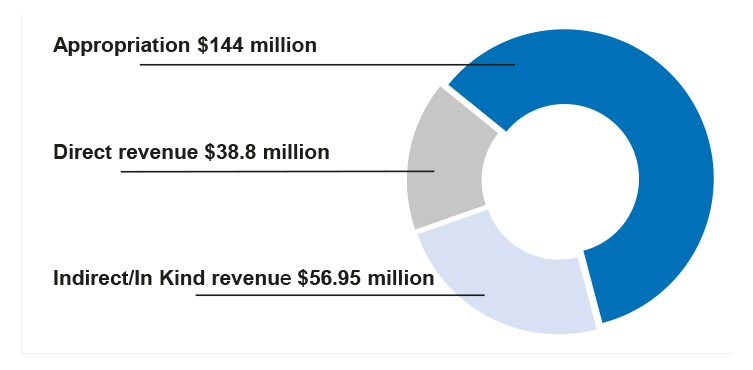

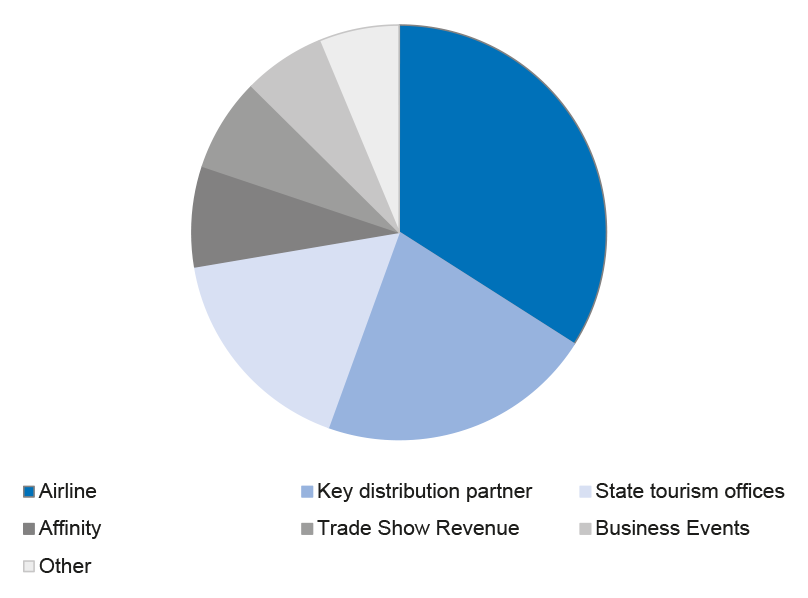

8. Tourism Australia has allocated funding for tourism on a sound and transparent basis. It has used data analysis to support decisions for allocating funds to tourism markets and to communication channels within each market. There were some weaknesses in performance reporting at an operational level with scope to adopt a more consistent approach to setting, calculating and reporting key performance indicators for international marketing campaigns.

Supporting findings

Development and implementation of tourism 2020.

9. Development and implementation of Tourism 2020 has been based on coordinated, targeted research. A national tourism research agenda was developed at an early stage to advise Tourism Ministers on research priorities and review opportunities to improve the dissemination of tourism research. In line with these research priorities, Tourism Research Australia within Austrade and Tourism Australia have provided targeted data and research to strengthen marketing and business decisions, and inform government priorities and strategies.

10. Implementation of the Tourism 2020 Strategy has been based on collaboration across government and the tourism industry. Tourism Ministers’ meetings have enabled collaboration between government on the development of a policy framework for Tourism 2020 and implementation of key strategies. Industry representatives have contributed to the development of Tourism 2020 priorities and strategies.

Monitoring of Tourism 2020 performance

11. The Tourism 2020 target of between $115 billion to $140 billion in visitor overnight spend by 2020 is a robust measure of performance that has been regularly monitored and reported by Austrade. Moreover, regular reporting of progress against the Tourism 2020 target has helped to ‘galvanise’ the sector and is a strength of Tourism 2020. Each state and territory government tourism organisation has developed a Tourism 2020 state based target to contribute towards the national upper goal of $140 billion in overnight expenditure. Reporting has shown that the visitor overnight spend was tracking around the lower end of the national target in 2015 and 2016, which represented moderate growth since the inception of Tourism 2020.

12. The key performance indicators adopted to assess the implementation of Tourism 2020 are relevant and reliable. While the suite of indicators for Tourism 2020 is comprehensive it is not complete as there has been no assessment of the overall economic impact of Tourism 2020.

Allocation of funding for tourism

13. Tourism Australia has governance arrangements in place that support sound and transparent decision making by the Board and executive management team. The roles and responsibilities of the Board are clearly defined, as are the governance processes for the Board, the executive management team, and the Audit and Finance Committee. Strategic planning is clearly linked to legislative requirements, strategies with objectives, and defined performance measures with targets. Strategies and risks are regularly reviewed.

14. Tourism Australia has allocated funding on a sound and transparent basis. Tourism Australia used data analysis to support its decisions for allocating funds to tourism markets and to each communication channel within each market. Over time this has resulted in a shift away from some mature markets (such as New Zealand) to fast growing markets (such as China), as well as an overall reduction in the number of markets being targeted—reflecting a targeted, more efficient use of government funding. In addition, Austrade’s administration of a major tourism supply side program (the Tourism Demand Driver Infrastructure program) was sound.

15. Tourism Australia’s marketing projects have target metrics articulated in the regional annual operating plan, and in partnership agreements. However, reporting against the performance measures in international tourism marketing campaigns varies in terms of how the measures are set, calculated and reported. There is scope to adopt a more consistent approach to setting, calculating and reporting these key performance indicators. There is also scope to assess the combined impact of Tourism Australia’s marketing and industry development activities through an aggregate Return on Investment study, potentially as part of the proposed 2017 evaluation of Tourism 2020.

Recommendation

Recommendation No. 1

Paragraph 4.34

Tourism Australia adopts a more consistent approach to setting, calculating and reporting key performance indicators for international tourism marketing campaigns.

Tourism Australia’s response : Agreed .

Summary of entity’s response

16. Tourism Australia’s summary of their response to the report is provided below. Full responses by Tourism Australia and by the Australian Trade and Investment Commission (Austrade) are provided at Appendix 1.

Tourism Australia has reviewed the report and welcomes the opportunity to formally respond to the audit findings and recommendations.

Key findings included Tourism Australia’s robust governance arrangements; compliance with Commonwealth Procurement rules; sound and transparent Government funding allocation processes; proficient strategic planning and strong risk management.

Tourism Australia accepts the recommendation to adopt a more consistent approach to the setting, calculating and reporting of key performance indicators for international tourism marketing campaigns. Effort to improve this area was already underway prior to the audit and will continue to be an area of focus. Tourism Australia will continue to refine this process to identify improvements in consistent campaign design, delivery and performance reporting.

1. Background

Tourism 2020.

1.1 Tourism 2020 is a whole-of-government strategy designed to build the resilience and competitiveness of Australia’s tourism industry. The strategy seeks to increase the demand for travel to and within Australia, as well as addressing a range of factors governing the supply of tourism services including investment, labour supply and tourism-related infrastructure. A Tourism 2020 goal has been established to achieve a potential overnight visitor spend (combined domestic and international) of between $115 billion and $140 billion annually (up from $70 billion in 2009), by 2020.

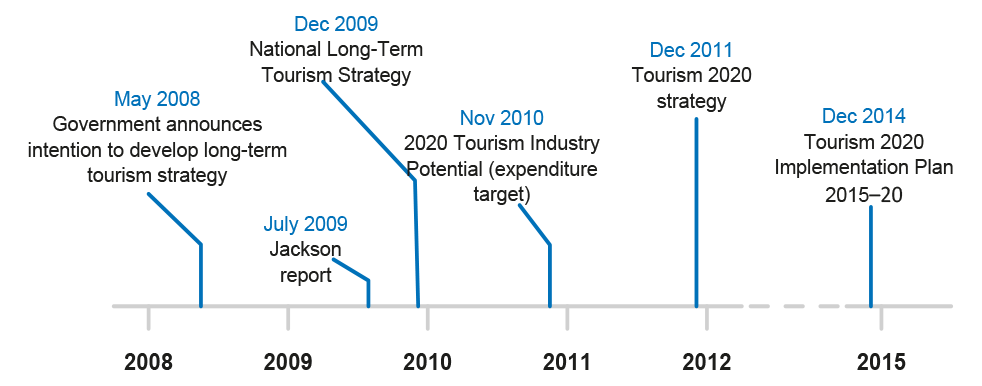

1.2 Tourism 2020, launched in December 2011, is the result of a policy process that commenced in May 2008 when the Australian Government announced its intention to develop a long-term tourism strategy to address the decline in Australia’s share of international tourism. In December 2009, the National Long-Term Tourism Strategy was launched with a focus on expanding Australia’s tourism industry through addressing a range of supply-side issues relating to the development of the tourism industry. A year later a growth target for the Australian tourism industry was released— 2020 Tourism Industry Potential .

1.3 An agreement between Australian Tourism Ministers sets the framework for jurisdictional collaboration and cooperation between governments and within the sector. It defines the general responsibilities and activities of the two levels of government and the respective roles of the Ministers. 1 A biannual meeting of the Ministers provides a forum that facilitates consultation and policy coordination, and progresses the implementation of the national strategy. Tourism Ministers may also agree, where appropriate, to work cooperatively on cross-portfolio matters or refer significant intergovernmental reform work to the Council of Australian Governments.

1.4 Tourism Ministers are supported by the Australian Standing Committee on Tourism. 2 This group is collectively responsible for implementing Tourism 2020, resolving issues that might otherwise require the attention of Tourism Ministers, and for providing advice to the Ministers on policy matters.

1.5 Within this commonwealth/state framework the Australian Trade and Investment Commission (Austrade) is responsible for coordinating and facilitating the implementation of Tourism 2020 at a national level, working with Australian Government entities and industry to develop sector policy positions, analyse sector research and report performance. Austrade is also responsible for managing the Tourism Demand Driver Infrastructure program, a partnership funding agreement between the Australian Government and the states and territories to build sector infrastructure.

1.6 Tourism Australia is the Australian Government entity responsible for attracting international visitors to Australia both for leisure and business events. Formed under the Tourism Australia Act 2004 , it delivers a wide range of marketing activity. 3

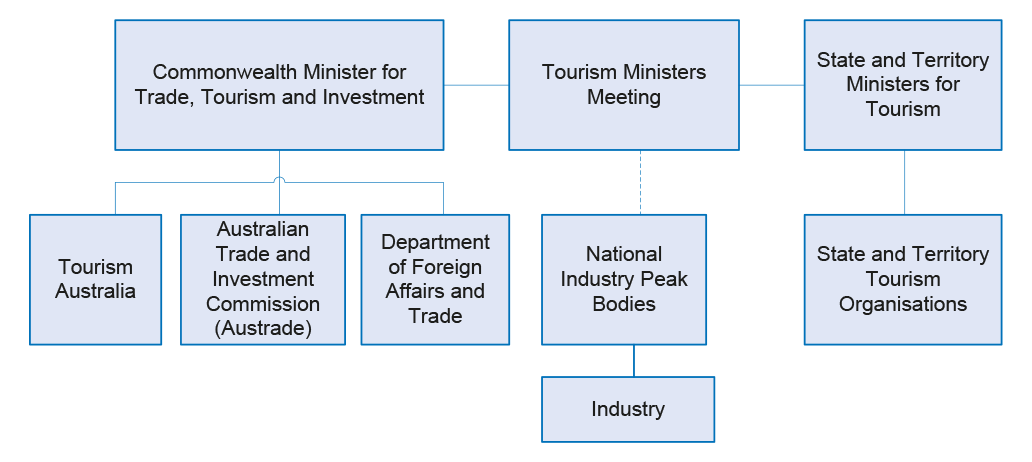

1.7 The Department of Foreign Affairs and Trade is responsible for leading Australia’s international tourism policy engagement. The department works to strengthen bilateral tourism relationships with important tourism markets and to leverage key multilateral tourism bodies. Figure 1.1 outlines the whole-of-government arrangements.

Figure 1.1: Whole-of-government arrangements for Tourism 2020

Source: ANAO.

1.8 Tourism 2020 has been designed to link stakeholders in the industry and provide a balanced focus on building the productive capacity of the tourism industry and destination marketing. The strategy also seeks to align the government and industry on key priorities.

1.9 The launch of Tourism 2020 was not accompanied by additional funding from the Australian Government. It was a strategy designed to optimise the existing level of government funding. In 2015–16 , the Australian Government allocated $179 million for tourism and promotion. This included $158 million to Tourism Australia to market Australia as a tourism destination internationally. 4 A further $14.3 million was allocated to Austrade to deliver the Tourism Demand Driver Infrastructure program. The program delivers infrastructure projects across Australia that contribute to Tourism 2020 outcomes by driving demand, improving quality and increasing tourism expenditure. Other additional resources included $4.4 million allocated to the Tasmania Regional Tourism Package and $2.6 million allocated to the Approved Destination Status Scheme to provide tour quality monitoring arrangements that underpin the Chinese inbound tourism market.

Audit approach

Audit objective.

1.10 The audit objective was to assess the effectiveness of the implementation of Tourism 2020 by Austrade and Tourism Australia.

1.11 To form a conclusion against the audit objective, the ANAO adopted the following high-level audit criteria:

1.12 The ANAO examined the implementation of Tourism 2020 by Austrade and Tourism Australia. The scope of this audit did not cover examination of the effectiveness of the Department of Foreign Affairs and Trade in leading Australia’s international tourism policy engagement, the Approved Destination Status Scheme or the Tasmania Regional Tourism Package.

1.13 The audit was conducted in accordance with the ANAO’s Auditing Standards at a cost to the ANAO of approximately $558,000.

1.14 The team members for this audit were Marian Allen, Elizabeth Wedgwood, Alison Palmer and Andrew Morris.

Methodology

1.15 The audit methodology included:

- a literature review of international tourism trends and policies;

- a review of files and documents from Austrade and Tourism Australia;

- economic analyses of the performance measures underpinning the Tourism 2020 target and strategy;

- key stakeholder interviews with state and territory tourism agencies, and industry representatives;

- interviews with the Board, Audit and Finance Committee and executive management team of Tourism Australia; and

- interviews with staff from the Department of Foreign Affairs and Trade, Austrade, Tourism Australia, the Department of Prime Minister and Cabinet, and the Department of the Treasury.

2. Development and implementation of Tourism 2020

Areas examined.

This chapter examines whether the development and implementation of Tourism 2020 has been supported by a sound evidence base, including effective engagement with government and industry.

Implementation of Tourism 2020 and associated policy development has been underpinned by an evidence base led by Tourism Research Australia (within Austrade) in collaboration with Tourism Australia. Tourism Ministers’ meetings have provided an effective forum for cross government collaboration and industry representatives have been consulted in the formulation of key priorities and strategies for Tourism 2020.

2.1 Launched in December 2011, Tourism 2020 was developed to reverse the long-term structural decline in visitor numbers and maximise the net economic benefits of tourism to the Australian economy—overnight trips and visitor nights fell by 4.5 per cent and 7.4 per cent respectively between 1998 and 2008. In part this decline was attributed to international economic constraints, the stronger Australian dollar and the increasingly competitive global tourism market.

2.2 Initial sector consultation and further research funded by the Australian Government stated that:

- there were economic benefits of expanding the sector, noting relatively large flow on benefits to the economy compared to similar action in a different sector of the economy;

- there were gaps in the research agenda for tourism that related to industry development and policy analysis and a role for government to conduct and disseminate research given the limited capacity of the sector to arrange and fund it; and

- there was a need for leadership to strengthen inter-government cooperation and to engender a commitment to work systematically with industry to identify institutional or market impediments that hold back growth of the sector.

2.3 A case was made for government intervention in relation to international destination marketing and major events on the basis of a ‘free-rider’ incentive in the tourism industry. This is where tourism related business cannot be prevented from obtaining the benefits of marketing provided by other businesses, creating an incentive for businesses in this sector to underinvest in destination marketing and major events. In this regard, the Productivity Commission (2015) concluded that there is a case for government involvement in the tourism industry on the basis of market failure, as long as the net benefits generated to the community outweigh the cost of government intervention. 5

Was Tourism 2020 based on coordinated research?

Development and implementation of Tourism 2020 has been based on coordinated, targeted research. A national tourism research agenda was developed at an early stage to advise Tourism Ministers on research priorities and review opportunities to improve the dissemination of tourism research. In line with these research priorities, Tourism Research Australia within Austrade and Tourism Australia have provided targeted data and research to strengthen marketing and business decisions, and inform government priorities and strategies.

2.4 The National Long-Term Tourism Strategy, the precursor to Tourism 2020, recommended the development of a national tourism research agenda. The aim of the agenda was to advise Tourism Ministers on research priorities; align tourism supply with demand research capabilities; report linkages between policy, marketing and research findings; and review opportunities to improve the dissemination of tourism research. In endorsing the strategy, Tourism Ministers agreed to an expanded role for Austrade’s principle research arm, Tourism Research Australia, which is to:

- produce a comprehensive state of the industry report that would provide a quantitative and qualitative assessment of industry performance, metrics for measuring the strategy and trend analysis;

- expand destination visitor surveys to underpin destination development plans;

- research issues affecting tourism including investment, productivity, labour and skills, and taxation;

- use Computable General Equilibrium 6 modelling to better understand linkages between tourism and the rest of the economy; and

- ensure the benefits of research are communicated and shared across the industry.

2.5 The Australian Government also agreed to establish a Tourism Research Advisory Board to coordinate the development and implementation of a national tourism research agenda. The Board would pursue an effective industry research program to enable key industry stakeholders to more accurately assess and respond to investment opportunities and challenges. The Board, disbanded in May 2016, has been replaced by industry led roundtable discussions with key government, industry and research stakeholders within each state and territory to identify current research priorities and gaps.

2.6 In 2010, Tourism Ministers established nine working groups to assess the barriers to growth identified in the National Long-Term Tourism Strategy (2009). Members of the Australian Standing Committee on Tourism chaired the working groups that comprised government and industry representatives. The working groups made progress in building an evidence base to support, for example, bilateral aviation negotiations, planning and regulatory frameworks and communication mechanisms to disseminate research. In addition, the working groups identified strategies for future research to support policy development and implementation. See Appendix 2 for more detail.

2.7 Research from the working groups provided the basis for the first annual State of the Industry Report developed by Tourism Research Australia and the focus of the national Tourism Directions Conference for government and industry representatives held in Canberra in November 2010. The conference agenda was developed to present and discuss issues affecting industry, and move the sector towards a unified, long-term approach to achieve the Tourism 2020 target.

2.8 In 2011, Austrade commissioned research to assess industry’s response to the National Long-Term Tourism Strategy. The report concluded that industry viewed relevant and detailed research as the single most important requirement to be addressed by the long-term strategy, and that the potential, or target, of between $115 billion and $140 billion annually, should be retained. The report also noted some industry confusion around the supply and demand elements of the strategy and recommended that governments engage more directly with industry to promote the benefits of Tourism 2020 by defining and promoting the tangible success of the strategy, demonstrating the links between the supply and demand elements, and using the option of new communication tools to keep the reporting message transparent and simple. Communication with the sector was restructured and a standardised Tourism 2020 presentation developed to promote consistency and clarity of language between all stakeholders.

2.9 The research focus developed by the Tourism Research Advisory Board has been expanded since 2009 through annual industry roundtables led by Austrade. The roundtables facilitate an exchange between government, tourism operators and the research community on research and policy priorities. The roundtables have been convened by Tourism Industry Councils and other bodies in host states and territories to identify current research priorities and gaps.

Research and analysis

2.10 Austrade and Tourism Australia share responsibility for sector research and analysis. Broadly, Austrade is responsible for research, data collection and analysis of tourism supply factors, and Tourism Australia for consumer demand factors.

Research by Austrade

2.11 The foundation for tracking international and domestic tourism is the International Visitor Survey and the National Visitor Survey administered by Tourism Research Australia. 7 These surveys address market failure in information provision. The data on travel patterns and expenditure has been collected over many years generating time series data to support policy making at all levels of government, industry planning, investment, marketing and promotion. 8

2.12 States and territories contribute financially to the conduct of these surveys through service level agreements negotiated annually or biannually. As at August 2016, states and territories contributed approximately one third of total cost ($8.4 million) of the International Visitors Survey and National Visitors Survey. These arrangements help to avoid duplication of effort and reduce costs. A review (2016) identified savings of between $13.4 million and $24.4 million through the consolidated approach, when compared to the cost of individually conducted surveys.

2.13 Reports from the two surveys are well regarded by stakeholders as measured through satisfaction surveys—81 per cent of respondents were either satisfied or very satisfied with the National Visitors Survey, and 79 per cent of respondents satisfied or very satisfied with the International Visitors Survey in 2015–16 . 9 Eighty-five per cent of respondents used research data provided by Tourism Research Australia. Of the tourism business operators that had used this data, 87 per cent used the research to help support marketing activity or business decisions. This was consistent with performance results from the previous two years. Importantly, Tourism Research Australia’s key performance measure reported in Austrade’s annual report is:

Proportion of tourism operators which use Austrade’s tourism research and information and say it helped support their marketing and business needs.

2.14 While the International Visitors Survey has sufficient level of accuracy for many purposes, for smaller regions within a state (such as regional Tasmania) the survey becomes less reliable. While acknowledging the issues with sample sizes for smaller regions, Austrade noted that contracts for the two surveys are due to expire in 2017, and that in developing new specifications, it will work closely with states and territories to determine whether increasing sample sizes in smaller regions is a priority. Where possible, Tourism Research Australia compiles a Destination Visitor Survey that aims to bridge the gap between the national surveys and meet disaggregated data needs for regional Australia. The Destination Visitor Survey program has two parts:

- the Visitor Profile and Satisfaction program profiles visitors to individual regional tourism destinations and reports on their satisfaction with their visit. This information is compiled into the Visitor Profile and Satisfaction benchmark database, enabling destinations to be benchmarked against others across a number of key indicators. Recent publications include Victoria: Great Ocean Road and Queensland: Gold Coast .

- the Strategic Regional Research program focuses on broader strategic issues that affect regional destinations.

2.15 Tourism Research Australia supports policy, marketing and industry development through research and data collection that includes:

- the State of the Industry—an annual publication that analyses the performance of the Australian tourism industry against the Tourism 2020 target, the challenges ahead, and how the industry needs to respond;

- the Tourism Investment Monitor, which provides an estimate of the total value of large-scale tourism projects;

- Tourism Forecasts, which provide ten-year forecasts for Australia’s inbound, domestic and outbound tourism sectors;

- annual Regional Tourism Profiles, which provide tourism demand and supply data for Australia’s tourism regions and all states and territories;

- analysis of the economic contribution of tourism, including tourism’s total contribution to Gross Domestic Product, exports, employment, businesses and productivity, at the state and national levels; and

- strategic regional research projects, for example, a report on Western Australia’s visitor centres and their influence on tourist behaviour released in September 2015.

2.16 A list of key publications produced by Tourism Research Australia in 2015–16 is listed at Appendix 3.

Research by Tourism Australia

2.17 In 2012, Tourism Australia established the Consumer Demand Project to collect insights from visitors and potential visitors from Australia’s key international tourism markets to understand Australia’s existing, and potential tourism appeal. Research insights and data have been shared with state and territory governments since its introduction. From 1 July 2016 state/territory governments will provide a financial contribution to the costs of the research project.

2.18 Tourism Australia also combines data from the International Visitor Survey with other national research such as the Australian Bureau of Statistics’ monthly report on Arrivals and Departures and Key Economic Indicators , and the Department of Infrastructure and Regional Development’s International Airline Activity and Airline on Time Performance Statistics to produce the quarterly International Market Update . The report provides key international market summaries including trends, changes in domestic and international aviation capacity, and industry news. The International Market Update is published online as is the data to support the work. Reports provide headline statistics only—the data is published to enable further analysis.

Has implementation of Tourism 2020 been based on collaboration between governments and industry?

Implementation of the Tourism 2020 Strategy has been based on collaboration across government and the tourism industry. Tourism Ministers’ meetings have enabled collaboration between government on the development of a policy framework for Tourism 2020 and implementation of key strategies. Industry representatives have contributed to the development of Tourism 2020 priorities and strategies.

2.19 A 2010 OECD report relating to tourism strategy development identified the importance of coordination between various levels of government, industry and key stakeholders as indicated in the following excerpt:

Addressing the major and multi-faceted challenges faced by the tourism industry demands an integrated approach to policy development across many government departments. Coherence and consistency are essential in the design and application of policies between all levels of government to ensure that tourism policies are effective. This understanding has led to an increased emphasis on ‘whole of government’ commitment … It has been shown that the development of a tourism strategy can play a key role in engaging government, industry, destination communities and other stakeholders to identify a vision and direction for tourism development and in setting priorities for implementing a long-term and sustainable vision for the tourism sector. Tourism strategies are increasingly emphasising public-private sector co-operation. 10

Collaboration across levels of government (vertical integration)

2.20 In December 2009, the Commonwealth and state/territory Tourism Ministers endorsed the National Long-Term Tourism Strategy based on the following principles:

- ensuring leadership—that is strategic, coordinated and capable of driving the implementation of the Strategy;

- informing industry and government—research that supports the long-term development of the Australian tourism industry;

- supporting growth—creating the environment to foster growth in the Australian tourism industry; and

- competing in a global environment—creating the right mix of quality product and promotion that is vital to competing successfully in the global market.

2.21 Tourism Ministers’ Meetings supported by the Australian Standing Committee on Tourism (ASCOT) have provided a framework for cross government collaboration. Development of Tourism 2020 has been based on input from across government and industry at critical junctures in the policy development/implementation process including:

- National Long-Term Tourism Strategy in 2009;

- Tourism 2020 in 2011; and

- the Tourism 2020 Implementation Plan ( 2015–20 ) developed in 2014 .

2.22 Figure 2.1 identifies key developments in relation to Tourism 2020.

Figure 2.1: Tourism 2020 timeline

2.23 The 2009 Strategic Review of Tourism Ministers’ Council resolved that successful implementation of the National Long-Term Tourism Strategy would require improvement to the way the Tourism Ministers’ Meetings (TMM) and ASCOT operated. The Strategic Review recommended a more active, outcome focused approach:

The formulation of a NLTTS [National Long-Term Tourism Strategy] represents an opportunity to break with the past and for TMM to be more outcome orientated. However, if this is to be successful there will need to be changes in the way that ASCOT operates. The NLTTS will need to move beyond aspirational or high level statements. It will need to be broken down into specific projects with clear deliverables … That responsibility must rest with ASCOT; there should be no sheltering behind the veil of collective responsibility.

2.24 The ANAO’s examination of the minutes from the Tourism Ministers’ Meetings and ASCOT meetings from 2010 to 2016 indicate that Tourism Ministers provided oversight of the progressive development from the Tourism 2020 strategy initiatied in 2011 to the 2020 Tourism Implementation Plan in 2014.

2.25 In August 2014, Tourism Ministers agreed to the Implementation Plan ( 2015–2020 ) developed by an ASCOT Steering Committee 11 in consultation with government and industry members. 12 The plan reflects a maturing of Tourism 2020 over four years, and includes a move away from broad goals to more outcome focused strategies. These strategies are linked to deliverables/timeframes with responsibility assigned to jurisdictions. These strategies are to:

- increase cross portfolio collaboration within all levels of Australian Governments;